Global Blister Packaging Market Size, Share, Opportunities, COVID-19 Impact, And Trends By Type (Compartment, Slide, Wallet), By Material (PVC, PVDC, PP, Others), By Technology (Cold-Form, Thermoformed), By End-User (Consumer Goods, Food, Pharmaceuticals), And By Geography - Forecasts From 2023 To 2028

- Published : Sep 2023

- Report Code : KSI061611233

- Pages : 145

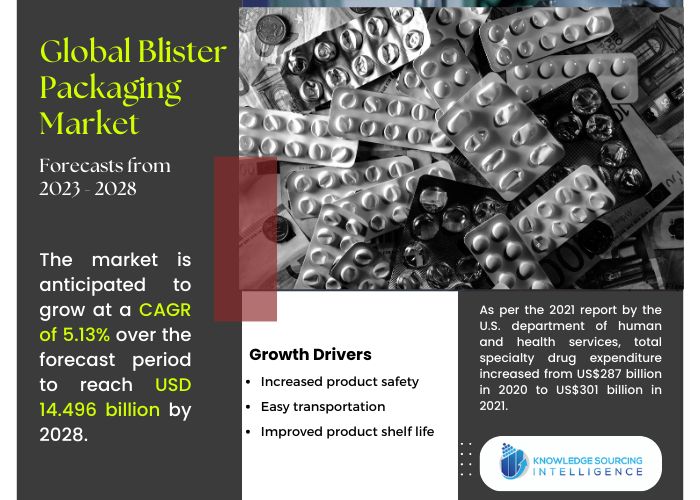

The global blister packaging market is predicted to grow at a CAGR of 5.13% from US$10.214 billion in 2021 to US$14.496 billion by 2028.

The global market is growing as it has become a more feasible choice due to the increased demand for product security from manufacturers, customers, and regulatory organizations. Further, most consumers store their medications in a temperature-variable environment that can be hazardous, which makes the packaging necessary for quality management and increased shelf life. Due to the ability to offer personal security throughout supply chains, cutting-edge technology in blisters, such as radio frequency identification tags with a seal applied outside the package, is expanding. The market is also anticipated to rise due to rising consumer demand for practical and simple-to-use packaging products and growing requirements for complying with safety laws. Additionally, there is a rising demand for personal care and pharmaceutical goods in industrialized regions like America, Asia, Europe, and others, where consumer spending on medical and personal care items is rising significantly.

The global blister packaging market is driven by rising development in the pharmaceutical sector.

The pharmaceutical sector heavily relies on blister packaging. Specialized packing choices enable pharmaceutical manufacturing firms to deliver medical items to patients without tampering with them or causing any damage. One of the choices for keeping medicinal goods secure, dry, and free of as many outside pollutants as feasible are blister packaging. There are many options for pharmaceutical packaging, including stoneware and glass storage and plastic bottles and containers. Medical necessities can be transported and packaged effectively in blister packaging. In addition, packaging shields the medications from impacts, heat, and wet environments, extending their shelf life and improving transportation capabilities.

Further, the expenditure on medicines is increasing with the global consumption of speciality drugs. For instance, as per the 2021 report by the U.S. Department of Human and Health Services, total speciality drug expenditure increased from US$287 billion in 2020 to US$301 billion in 2021. The demand for packaging is directly driven by the fact that the manufacture of medications is always growing to keep up with the identification of new ailments and treatments. As they have tamper-free, leak-proof packaging solutions that may be used for bulk operations to achieve quick and reliable packing, flexible alternatives to packaging like blister packaging are among the most popular techniques.

Moreover, pharmaceutical packaging suppliers are searching for more easily recyclable materials as environmental regulations tighten. The majority of blister packaging currently uses a lot of materials, including PVC and PVDC, etc. Unfortunately, these also involve single-use plastics that are harmful to the environment and cannot be reused or composted. To assist the recyclability of the blister packages, businesses are creating new recycled thermoformed plastic methods and materials. In addition, many companies are developing novel recyclable packaging materials for blister packaging.

Market Developments:

- Pfeifer announced opening a 61,000-square-foot facility in Chennai, India, in May 2022, marking the company's only drug development center in Asia. The USD 20 million investments will be used to expand the company's product line, including APIs and FDFs.

- Terracycle collaborated with Honeywell in May 2022 to conclude the recycling potential of Honeywell's Aclar Barrier Layer Blisters. It has been determined that Honeywell's film material is compostable for PVC and PETG-based blisters, including those used in Aclar Edge bottles and other pharmaceutical applications. Aclar's film blister technical recyclability is being evaluated on a lab scale and officially declared in the real world.

Based on material, the PVC segment is expected to witness robust growth.

PVC blister packaging is a type of packaging that consists of a thermoformed PVC plastic shell or blister and a printed card backing. It is widely used in various industries, including pharmaceuticals, medical devices, food and beverage, and consumer goods. PVC blister packaging offers numerous advantages over other forms of packaging, including excellent product visibility, protection against tampering, and resistance to moisture and other environmental factors. The PVC blister packaging market has been experiencing steady growth in recent years, driven by factors such as the growth in the healthcare industry, the rise of e-commerce and home delivery services, the demand for convenience and portability, technological advancements in blister packaging, and the growth of emerging markets. However, the impact of environmental concerns and regulatory restrictions on the use of PVC may slow the growth of the PVC blister packaging market in the long term.

Asia Pacific accounted for a major share of the global blister packaging market in 2021.

The global blister packaging has been segmented by geography into North America, South America, Europe, the Middle East and Africa, and the Asia Pacific.

The Indian blister packaging market is anticipated to grow significantly during the projected period. This growth can be attributed to various factors, such as the ageing population in India. With advances in medical technology and healthcare, people in India are living longer than ever before, and the country's elderly population is growing rapidly. As people age, they tend to require more medication, which has led to an increase in demand for pharmaceutical products. Blister packaging is a popular packaging solution for pharmaceutical products as it provides protection from contamination and tampering, which is especially important for the elderly population with weakened immune systems. Blister packaging also offers other benefits for the elderly population. For example, it is easy to open, which can be especially important for those with arthritis or other conditions that affect hand dexterity. For instance, in May 2020, Constantia Flexibles started the world's first sustainable and environment-friendly packaging dedicated manufacturing plant in India's Gujarat, meeting all modern world requirements.

Global Blister Packaging Market Scope:

| Report Metric | Details |

| Market Size Value in 2021 | US$10.214 billion |

| Market Size Value in 2028 | US$14.496 billion |

| Growth Rate | CAGR of 5.13% from 2021 to 2028 |

| Base Year | 2021 |

| Forecast Period | 2023 – 2028 |

| Forecast Unit (Value) | USD Billion |

| Segments Covered | Type, Material, Technology, End-User, and Geography |

| Regions Covered | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies Covered | Amcor Limited, Sonoco Products Company, WestRock, Honeywell International LLC, Tekni-Plex Inc., Dow Chemical Company, Klöckner Pentaplast Group, Constantia Flexibles, Mister Blister, VisiPak, Ecobliss Holding BV, Catty Corporation, perlen packaging, and more. |

| Customization Scope | Free report customization with purchase |

Market Segmentation:

- BY TYPE

- Compartment

- Slide

- Wallet

- BY MATERIAL

- PVC

- PVDC

- PP

- Others

- BY TECHNOLOGY

- Cold-Form

- Thermoformed

- BY END-USER

- Consumer Goods

- Food

- Pharmaceuticals

- BY GEOGRAPHY

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- United Kingdom

- France

- Others

- Middle East and Africa

- Saudi Arabia

- Israel

- Others

- Asia Pacific

- China

- Japan

- South Korea

- India

- Others

- North America

Frequently Asked Questions (FAQs)

1. INTRODUCTION

1.1. Market Overview

1.2. Market Definition

1.3. Scope of the Study

1.4. Market Segmentation

1.5. Currency

1.6. Assumptions

1.7. Base, and Forecast Years Timeline

2. RESEARCH METHODOLOGY

2.1. Research Data

2.2. Assumptions

3. EXECUTIVE SUMMARY

3.1. Research Highlights

4. MARKET DYNAMICS

4.1. Market Drivers

4.2. Market Restraints

4.3. Porter’s Five Force Analysis

4.3.1. Bargaining Power of Suppliers

4.3.2. Bargaining Power of Buyers

4.3.3. Threat of New Entrants

4.3.4. Threat of Substitutes

4.3.5. Competitive Rivalry in the Industry

4.4. Industry Value Chain Analysis

5. GLOBAL BLISTER PACKAGING MARKET, BY TYPE

5.1. Introduction

5.2. Compartment

5.3. Slide

5.4. Wallet

6. GLOBAL BLISTER PACKAGING MARKET, BY MATERIAL

6.1. Introduction

6.2. PVC

6.3. PVDC

6.4. PP

6.5. Others

7. GLOBAL BLISTER PACKAGING MARKET, BY TECHNOLOGY

7.1. Introduction

7.2. Cold-Form

7.3. Thermoformed

8. GLOBAL BLISTER PACKAGING MARKET, BY END-USER

8.1. Introduction

8.2. Consumer Goods

8.3. Food

8.4. Pharmaceuticals

9. GLOBAL BLISTER PACKAGING MARKET, BY GEOGRAPHY

9.1. Introduction

9.2. North America

9.2.1. By Type

9.2.2. By Material

9.2.3. By Technology

9.2.4. By End User

9.2.5. By Country

9.2.5.1. United States

9.2.5.1.1. By Type

9.2.5.1.2. By Material

9.2.5.1.3. By Technology

9.2.5.1.4. By End User

9.2.5.2. Canada

9.2.5.2.1. By Type

9.2.5.2.2. By Material

9.2.5.2.3. By Technology

9.2.5.2.4. By End User

9.2.5.3. Mexico

9.2.5.3.1. By Type

9.2.5.3.2. By Material

9.2.5.3.3. By Technology

9.2.5.3.4. By End User

9.3. South America

9.3.1. By Type

9.3.2. By Material

9.3.3. By Technology

9.3.4. By End User

9.3.5. By Country

9.3.5.1. Brazil

9.3.5.1.1. By Type

9.3.5.1.2. By Material

9.3.5.1.3. By Technology

9.3.5.1.4. By End User

9.3.5.2. Argentina

9.3.5.2.1. By Type

9.3.5.2.2. By Material

9.3.5.2.3. By Technology

9.3.5.2.4. By End User

9.3.5.3. Others

9.4. Europe

9.4.1. By Type

9.4.2. By Material

9.4.3. By Technology

9.4.4. By End User

9.4.5. By Country

9.4.5.1. Germany

9.4.5.1.1. By Type

9.4.5.1.2. By Material

9.4.5.1.3. By Technology

9.4.5.1.4. By End User

9.4.5.2. United Kingdom

9.4.5.2.1. By Type

9.4.5.2.2. By Material

9.4.5.2.3. By Technology

9.4.5.2.4. By End User

9.4.5.3. France

9.4.5.3.1. By Type

9.4.5.3.2. By Material

9.4.5.3.3. By Technology

9.4.5.3.4. By End User

9.4.5.4. Others

9.5. Middle East and Africa

9.5.1. By Type

9.5.2. By Material

9.5.3. By Technology

9.5.4. By End User

9.5.5. By Country

9.5.5.1. Saudi Arabia

9.5.5.1.1. By Type

9.5.5.1.2. By Material

9.5.5.1.3. By Technology

9.5.5.1.4. By End User

9.5.5.2. Israel

9.5.5.2.1. By Type

9.5.5.2.2. By Material

9.5.5.2.3. By Technology

9.5.5.2.4. By End User

9.5.5.3. Others

9.6. Asia Pacific

9.6.1. By Type

9.6.2. By Material

9.6.3. By Technology

9.6.4. By End User

9.6.5. By Country

9.6.5.1. China

9.6.5.1.1. By Type

9.6.5.1.2. By Material

9.6.5.1.3. By Technology

9.6.5.1.4. By End User

9.6.5.2. Japan

9.6.5.2.1. By Type

9.6.5.2.2. By Material

9.6.5.2.3. By Technology

9.6.5.2.4. By End User

9.6.5.3. South Korea

9.6.5.3.1. By Type

9.6.5.3.2. By Material

9.6.5.3.3. By Technology

9.6.5.3.4. By End User

9.6.5.4. India

9.6.5.4.1. By Type

9.6.5.4.2. By Material

9.6.5.4.3. By Technology

9.6.5.4.4. By End User

9.6.5.5. Others

10. COMPETITIVE ENVIRONMENT AND ANALYSIS

10.1. Major Players and Strategy Analysis

10.2. Emerging Players and Market Lucrativeness

10.3. Mergers, Acquisitions, Agreements, and Collaborations

10.4. Vendor Competitiveness Matrix

11. COMPANY PROFILES

11.1. Amcor Limited

11.2. Sonoco Products Company

11.3. WestRock

11.4. Honeywell International LLC

11.5. Tekni-Plex Inc.

11.6. Dow Chemical Company

11.7. Klöckner Pentaplast Group

11.8. Constantia Flexibles

11.9. Mister Blister

11.10. VisiPak

11.11. Ecobliss Holding BV

11.12. Catty Corporation

11.13. perlen packaging

11.14. Schreiner Group

11.15. Powerpack Industries LLC

11.16. Hangzhou Xunda Clamshell Packaging Co., Ltd.

11.17. Luoyang Dirante Pharmaceutical Packaging Material Co., Ltd.

11.18. Vinpac Innovations

11.19. Uniworth Enterprises LLP

Amcor Limited

Sonoco Products Company

WestRock

Honeywell International LLC

Dow Chemical Company

Klöckner Pentaplast Group

Constantia Flexibles

Mister Blister

VisiPak

Ecobliss Holding BV

Catty Corporation

perlen packaging

Schreiner Group

Powerpack Industries LLC

Hangzhou Xunda Clamshell Packaging Co., Ltd.

Luoyang Dirante Pharmaceutical Packaging Material Co., Ltd.

Vinpac Innovations

Uniworth Enterprises LLP

Related Reports

| Report Name | Published Month | Get Sample PDF |

|---|---|---|

| North America Blister Packaging Market Share & Trends: 2023 - 2028 | May 2023 | |

| South America Blister Packaging Market Size & Share: 2023 - 2028 | May 2023 | |

| Europe Blister Packaging Market Size & Share: Report 2023 - 2028 | May 2023 | |

| Middle East and Africa Blister Packaging Market share: 2023 - 2028 | May 2023 | |

| Asia Pacific Blister Packaging Market Size: Report, 2023-2028 | May 2023 |